repossessed prefab homes

Navigating the world of repossessed prefab homes can be a rewarding yet complex journey. At first glance, these homes offer significant savings and the allure of quick installation and modern design. However, understanding their nuances requires expertise and a focus on authenticity, a factor that often gets overlooked in discussions about prefabricated housing.

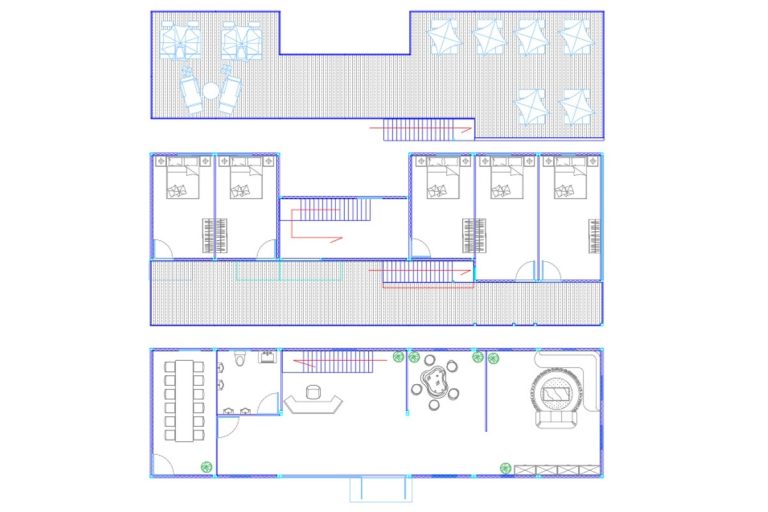

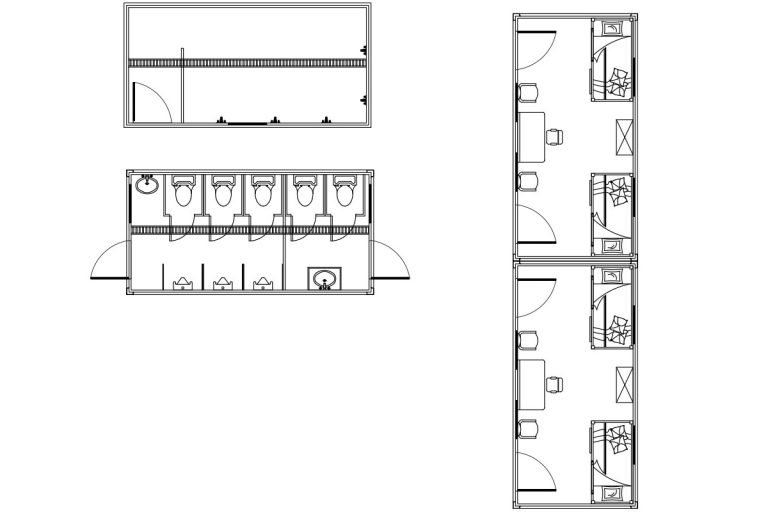

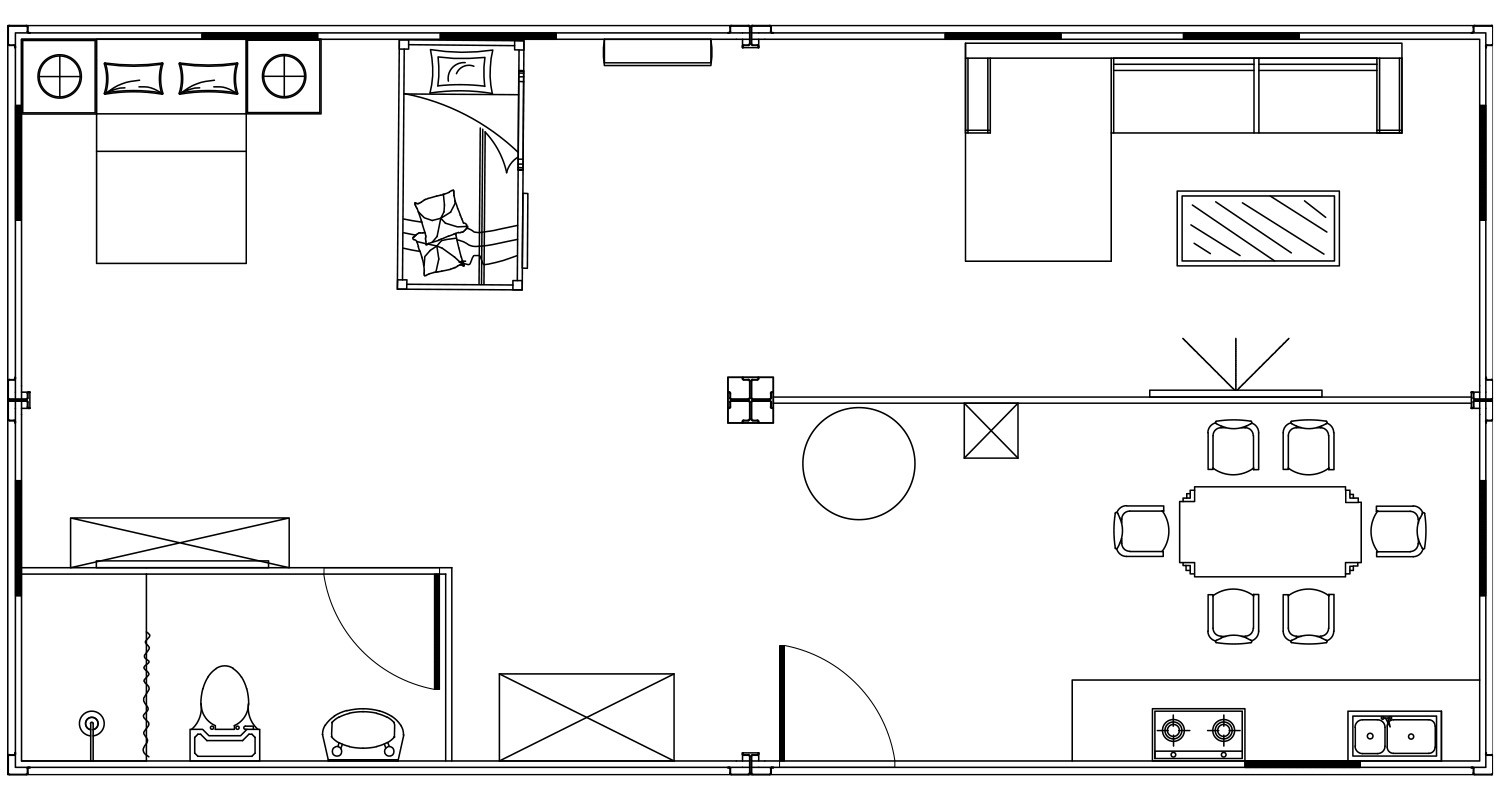

Repossessed prefab homes, often referred to as modular or manufactured homes, are properties reclaimed by lenders after the previous owners defaulted on their mortgages. These homes, having already been constructed off-site using efficient, quality-controlled processes, offer notable advantages. For one, they are often more affordable, selling below market value to ensure rapid turnover. However, the purchase of a repossessed home carries its own set of challenges and benefits that require careful consideration.

One prominent advantage of buying a repossessed prefab home is the potential for cost savings. Repossessed properties are typically sold at auction, with the price reflecting the lender's desire to recoup as much of the defaulted loan as possible. This scenario often results in prices well below the home's original market value. For savvy buyers, this presents an opportunity to acquire modern housing at a fraction of the cost. Still, it is crucial to conduct thorough due diligence before investing in such properties.

The experience of buying a repossessed prefab home also demands an understanding of the legal and financial processes involved. Potential buyers must be prepared to navigate the often intricate auction process. It is advisable to work with professionals familiar with real estate and foreclosure laws to avoid pitfalls that may arise from hidden liens or legal obligations attached to the property. This expertise ensures a smooth transition from purchase to ownership, with fewer unanticipated financial burdens.repossessed prefab homes

Another consideration is the structural integrity and condition of the repossessed prefab home. While prefab homes are built to stringent standards and offer durable, sustainable living solutions, a repossessed property might have suffered neglect or damage due to its previous owner's financial distress. Hiring a qualified inspector to assess the home's condition can uncover necessary repairs or updates, ensuring the property meets safety and habitability standards before purchase.

Furthermore, potential buyers should assess the long-term value and energy efficiency of the repossessed prefab home. Modern prefab homes are often equipped with energy-saving features and innovative design solutions that add to their value. Prospective buyers should review these aspects with the assistance of professionals who understand sustainable housing trends and can advise on potential upgrades or modifications that enhance both livability and market value.

Trustworthiness in the marketplace is crucial. Buyers must engage reputable lenders and sellers who have demonstrated honesty and integrity in their dealings. Seeking testimonials from previous customers and verifying the company's credentials can provide assurance of a trustworthy transaction. By verifying the seller’s track record, buyers enhance their confidence in the purchase and reduce the risk of unforeseen complications.

In conclusion, repossessed prefab homes represent a burgeoning opportunity for those willing to embrace a thorough search and evaluation process. By leveraging both personal experience and professional expertise, buyers can navigate this complex market with an authoritative and informed approach. They safeguard their investment against potential hazards while maximizing the benefits of modern, affordable housing. The journey may be intricate, but for those who prioritize trust and proficiency, repossessed prefab homes present a unique and rewarding investment in today's housing market.